Market-leading solution for monitoring, preventing money laundering and terrorist financing (AML/CFT), fully compliant with best practices and Brazilian legislation.

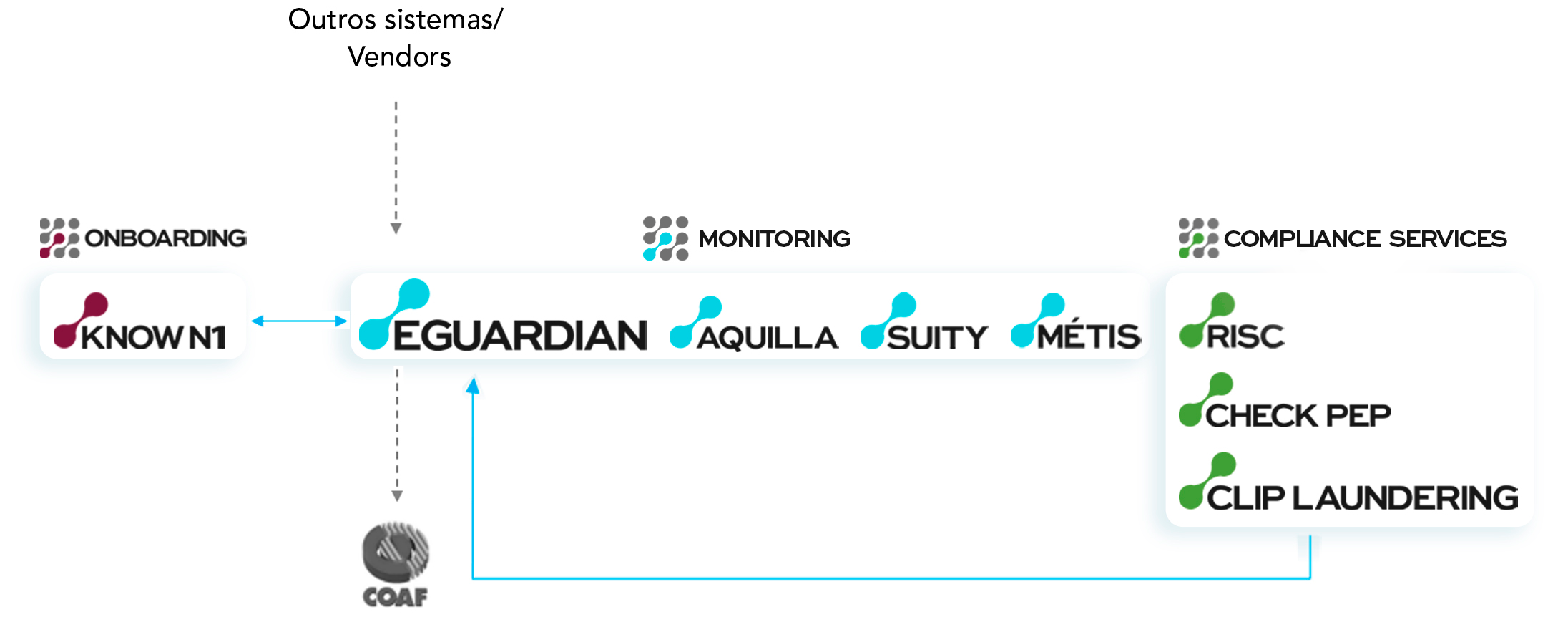

Launched in 2007, e-Guardian is the leading technology tool for AML/CFT, supporting companies from different sectors in complying with their regulatory obligations safely and efficiently.

Through continuous monitoring of customer financial behavior, registration data, socioeconomic profile, restrictive lists, sanctions, and PEPs, among others, it is possible to perform hundreds of cross-data monitoring scenarios configured according to the institution’s market segment, in addition to customized parameterizations according to the nature of the operation, type of risk, and type of person/organization.

The tool is in its new generation, e-Guardian IX, completely revamped and with features that enhance the platform’s intelligence, usability, and analysis capabilities.