CHECK PEP and CLIP LAUNDERING are searching services, with a wide internal and external database, driven to identify the exposure of corporations, individuals and their related ones in PEPs lists (politically exposed person) and adverse media. These services own with a wide internal and external database and allowing institutions to be diligent in the best practices of AML (anti money laundering).

Both were developed to attend the regulatory requirements for banks and other financial institutions. Today, with the growing demand in terms of Compliance Legislation, CHECK PEP and CLIP LAUNDERING have been supporting institutions from different business sectors for the qualification and AML procedures of their counterparts.

CHECK PEP is the Advice research service that performs the complete search for PEPs and their related ones, covering the Executive, Legislative and Judiciary departments, as well as the Public Prosecutor’s Office and senior leadership positions in government companies.

The services are totally in compliance with the brazilian recent regulations.

Created in 2008, CLIP LAUNDERING provides a deep search in the adverse, negative and disreputable media, focusing mainly on money laundering crimes. It attends the Brazilian Federal Law 12683/2012, related to the prevention of money laundering and financing of terrorism (PLD-FT).

The services are totally in compliance with the brazilian recent regulations.

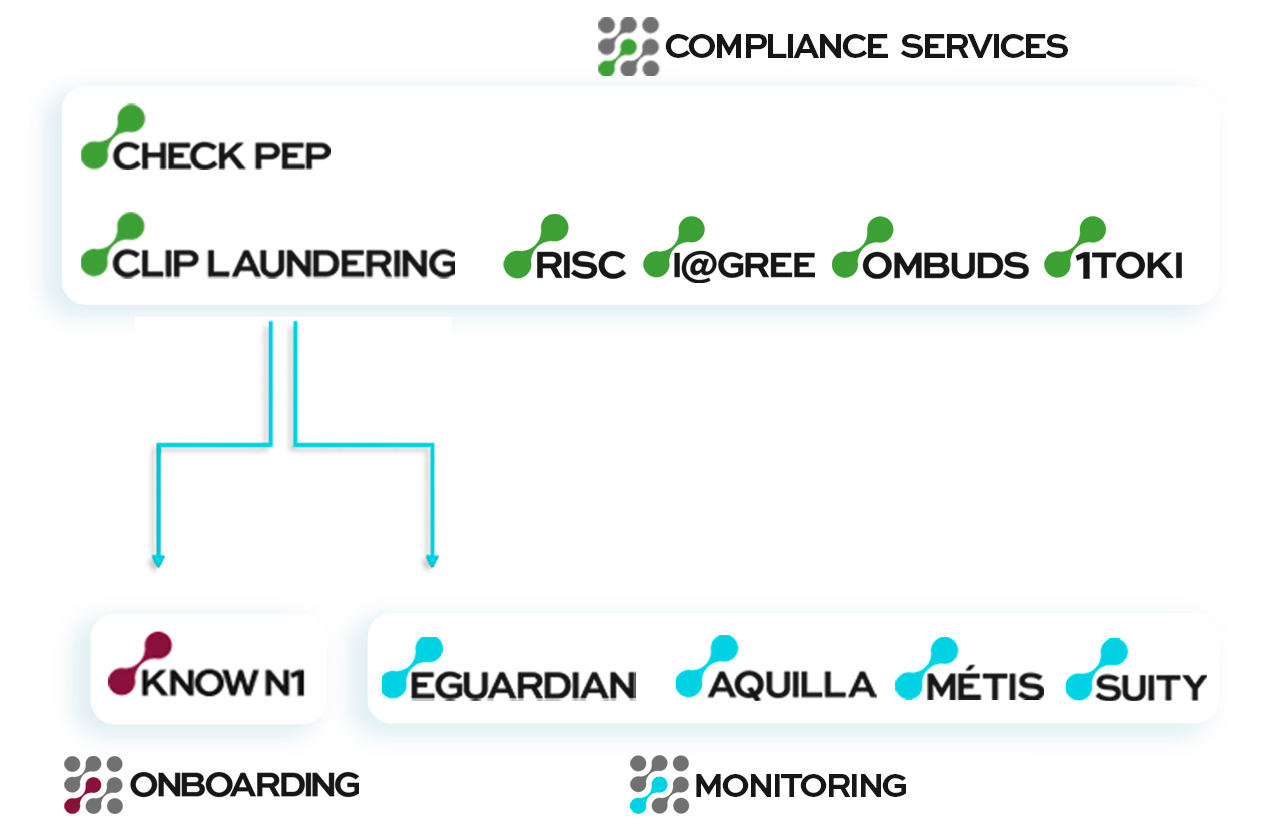

CHECK PEP and CLIP LAUNDERING can be combined with other Advice products and services, creating a systemic solution in compliance, according to the institution needs and 100% in compliance with the laws and norms required by the regulatory agents.

KNOW N1¹

Know your Counterpart (KYC) Onboarding process management for customers, employees, business partners and suppliers, including registration, verification and validation of register information.

EGUARDIAN²

Ongoing monitoring of financial and register behavior for customers and counterparties, allowing institutions to be diligent about national and global practices against money laundering and terrorism financing (PLD-FT).

RISC³

Services related to risk mitigation, such as process research, certificates, international sanctions lists, restrictive lists, among others.

São Paulo – SP: 925 Paulista Avenue – 8th Floor – Units 81/82 – Bela Vista – 01311-100

Petrópolis – RJ: 9153 União Indústria Road – Rooms 211 and 212 – 25730-736

Blumenau – SC: 727 XV de Novembro St – 2nd Floor – Downtown – 89010-001

To access the whistleblowing channel, click here or point your cellphone at the QR code below.

Copyright © 2021. All rights reserved.